Pre-Approval Credit Check: Things for a Smooth Financial. In today’s fast-paced world, understanding financial tools is key to making smarter decisions. A pre-approval credit check is an essential step for those seeking loans or credit options, whether you’re buying a home, car, or applying for a credit card. This article unpacks the process, its benefits, and how to maximize your chances of approval.

What Is a Pre-Approval Credit Check?

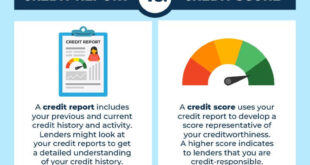

A pre-approval credit check is a preliminary review conducted by lenders to determine your creditworthiness. It provides you with an estimate of how much credit or loan you qualify for, based on your financial profile. Unlike a full credit inquiry, this process usually involves a soft credit check that doesn’t negatively impact your credit score.

Benefits of a Pre-Approval Credit Check

- Clarity on Your Borrowing Power

It helps you understand how much loan you can afford, setting realistic financial expectations. - Strengthens Your Negotiation Power

Sellers and lenders may take your application more seriously if you’re pre-approved. - Saves Time and Effort

Focus your search on loans or credit products tailored to your financial standing. - Improves Approval Odds

Pre-approval identifies potential issues that could derail your application, allowing you to address them early. - Minimizes Credit Score Impact

Unlike hard inquiries, soft credit checks typically have no effect on your credit score.

The Pre-Approval Process: Step by Step

- Assess Your Credit Report

Review your credit score and history. Websites like AnnualCreditReport.com provide free credit reports. - Gather Required Documents

Prepare proof of income, employment verification, and identification details. - Choose the Right Lender

Compare lenders for favorable terms and conditions. - Submit a Pre-Approval Application

Provide the necessary information, including your credit history and financial details. - Review Pre-Approval Terms

Examine the lender’s offer, paying attention to interest rates and borrowing limits. - Finalize the Application

If satisfied, proceed to complete the formal loan or credit application.

Factors Affecting Your Pre-Approval

- Credit Score

Higher scores generally lead to better offers. Aim for a score of 700+ for competitive terms. - Debt-to-Income Ratio (DTI)

Lenders prefer a DTI below 36%. - Employment Stability

Consistent income increases your chances of approval. - Credit History Length

Longer histories provide more insight into your financial behavior. - Outstanding Debts

Minimize existing debts to improve your profile.

10 Tips for a Successful Pre-Approval Credit Check

- Check Your Credit Report for Errors

Fix inaccuracies that may lower your score. - Pay Down Existing Debts

Reduce balances to improve your DTI ratio. - Avoid New Credit Applications

Multiple hard inquiries can negatively impact your credit. - Maintain Consistent Income

Job changes might raise red flags for lenders. - Limit Credit Utilization

Keep utilization under 30% of your total credit limit. - Research Lender Requirements

Understand each lender’s criteria before applying. - Stay Up-to-Date with Bills

Missed payments can reduce your chances of approval. - Know Your Financial Goals

Be clear about how much you want to borrow and why. - Work with a Financial Advisor

Professional advice can help optimize your profile. - Be Honest on Your Application

Provide accurate details to avoid disqualification.

10 FAQs About Pre-Approval Credit Checks

- Does a pre-approval guarantee loan approval?

No, it’s an initial assessment. Final approval depends on additional checks. - How long does pre-approval last?

Typically 60–90 days, but it varies by lender. - Does pre-approval affect my credit score?

No, as it usually involves a soft inquiry. - Can I apply with multiple lenders?

Yes, but too many inquiries may affect your profile. - What’s the minimum credit score for pre-approval?

It varies; most lenders prefer 620 or higher. - What happens if I’m denied pre-approval?

Review the reasons and work on improving your profile before reapplying. - Is pre-approval only for mortgages?

No, it’s also available for auto loans, credit cards, and personal loans. - What’s the difference between pre-qualification and pre-approval?

Pre-qualification is less rigorous and doesn’t carry the same weight as pre-approval. - Can I change lenders after pre-approval?

Yes, pre-approval is non-binding. - How quickly can I get pre-approved?

Many lenders provide instant results, while others may take a few days.

Conclusion

A pre-approval credit check is a valuable tool for navigating the financial landscape. By understanding its process and preparing diligently, you can secure favorable loan terms and avoid common pitfalls. Taking proactive steps to enhance your credit profile not only boosts your pre-approval chances but also empowers you in future financial endeavors.

In summary, while pre-approval is not a guarantee, it’s an essential step for anyone seeking credit or loans. Be informed, stay prepared, and leverage this process to unlock opportunities that align with your financial goals.

credit.suarajatim.com

credit.suarajatim.com