Soft Credit Request: Everything You Need to Know. A soft credit request is a crucial term in the world of personal finance and credit management. It plays a significant role in determining your financial opportunities without negatively impacting your credit score. This comprehensive guide will help you understand soft credit requests, their benefits, and their practical applications.

What is a Soft Credit Request?

A soft credit request, often referred to as a soft inquiry, is a type of credit check that does not affect your credit score. These inquiries occur when:

- You check your own credit.

- A lender pre-approves you for a loan or credit card.

- A background check involves credit verification for employment or rental purposes.

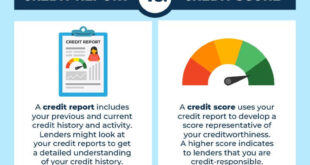

Unlike a hard credit inquiry, which lenders use to evaluate creditworthiness for specific applications, soft requests are informational and have no impact on your credit score.

Benefits of a Soft Credit Request

- No Credit Score Impact

Soft inquiries leave no trace on your credit report that lenders use to calculate scores, ensuring no dips in your credit rating. - Pre-Qualification for Loans

Many lenders use soft credit requests to provide pre-approval offers, helping you explore loan options without affecting your credit score. - Credit Monitoring

Consumers can monitor their credit reports regularly to identify errors, track score improvements, or detect fraudulent activities. - Privacy-Friendly

Since soft credit checks are not visible to lenders, they maintain your privacy when exploring financial options.

Common Uses of Soft Credit Requests

- Personal Credit Monitoring

Tools like Credit Karma allow individuals to review their credit status without repercussions. - Pre-Approval Offers

Credit card companies and lenders use soft inquiries to pre-approve you for loans or cards. - Employment Background Checks

Employers may perform soft credit requests during the hiring process to evaluate financial responsibility. - Apartment Rental Applications

Landlords often use soft credit requests to assess tenant reliability without triggering a hard inquiry. - Insurance Premium Assessment

Some insurers perform soft inquiries to determine risk levels and set premiums.

Differences Between Soft and Hard Credit Requests

| Aspect | Soft Credit Request | Hard Credit Request |

|---|---|---|

| Impact on Credit Score | None | May lower credit score |

| Who Can See It | Only the individual | Visible to lenders and creditors |

| Purpose | Informational | For loan/credit application approval |

| Examples | Pre-approvals, personal checks | Applying for mortgages, car loans, credit cards |

How to Use Soft Credit Requests Effectively

- Monitor Your Credit Regularly

Take advantage of soft inquiries to stay informed about your credit status and avoid potential issues. - Research Pre-Approval Offers

Use these inquiries to explore credit cards or loans without the commitment of applying formally. - Prepare for Large Purchases

Check your credit to understand your financial standing before making significant credit-based purchases like homes or cars. - Protect Against Identity Theft

Regularly reviewing your credit report can help you identify unauthorized activities early.

10 Tips for Managing Soft Credit Requests

- Use credit monitoring tools to stay updated on your credit score.

- Check your credit report at least once a year through free services like AnnualCreditReport.com.

- Avoid unnecessary hard credit inquiries by opting for pre-approval offers first.

- Educate yourself about the types of soft credit checks lenders perform.

- Stay informed about changes in credit reporting policies.

- Use soft credit requests to gauge your eligibility for loans or cards before applying.

- Be cautious with companies offering free credit checks; ensure they’re legitimate.

- Opt for rental properties or services that use soft inquiries instead of hard pulls.

- Keep personal financial information secure to minimize risks during checks.

- Maintain a healthy credit mix to improve your creditworthiness for both soft and hard inquiries.

10 FAQs About Soft Credit Requests

- What is the difference between a soft and hard credit request?

A soft inquiry doesn’t affect your credit score, while a hard inquiry might lower it temporarily. - Can soft inquiries be seen by lenders?

No, they are only visible to you when reviewing your credit report. - How many soft credit requests can I make?

There’s no limit, and multiple soft inquiries won’t harm your score. - Why do employers perform soft credit requests?

To assess financial responsibility without impacting your credit history. - Do soft inquiries expire from credit reports?

Yes, typically after 12–24 months, though they don’t affect scores. - Can I use soft credit checks for pre-qualifying loans?

Yes, many lenders offer pre-qualification through soft inquiries. - Do soft credit requests include credit scores?

Often, yes, they provide an overview of your score and credit details. - Can soft inquiries detect identity theft?

Yes, monitoring can help identify unauthorized checks or activities. - Do landlords prefer soft credit checks?

Some landlords use them as a non-invasive way to assess reliability. - Are soft credit requests mandatory for credit monitoring?

Yes, they are essential for checking your credit without harming your score.

Conclusion

Soft credit requests are invaluable tools for managing personal finances. Unlike hard inquiries, they allow you to explore financial opportunities, monitor your credit health, and secure pre-approvals without affecting your credit score. By understanding their applications, benefits, and limitations, you can make informed financial decisions that protect and enhance your credit standing.

Embrace soft credit requests as a proactive measure for maintaining a strong financial foundation while safeguarding your credit score. When used effectively, these inquiries can provide significant advantages in both personal and professional financial planning.

credit.suarajatim.com

credit.suarajatim.com