Low Credit Score Credit Cards: A Guide to Financial Freedom. Having a low credit score can be a significant barrier when trying to access credit cards and loans. However, there are options available specifically designed for individuals with lower credit scores. This article will delve into the world of low credit score credit cards, explaining what they are, their benefits, how to choose the right one, and tips for managing them effectively.

Understanding Low Credit Score Credit Cards

- What Are Low Credit Score Credit Cards?

Low credit score credit cards are financial products tailored for individuals with poor or limited credit histories. These cards may have higher interest rates and lower credit limits but can provide an opportunity to rebuild credit over time. - Why Do Credit Scores Matter?

Credit scores range from 300 to 850, with higher scores indicating better creditworthiness. Lenders use these scores to evaluate the risk of lending money. A low credit score can result from missed payments, high credit utilization, or a lack of credit history, making it challenging to secure loans or credit cards. - Types of Low Credit Score Credit Cards

There are primarily two types of credit cards available for those with low credit scores: secured credit cards and unsecured credit cards. Secured cards require a cash deposit as collateral, while unsecured cards do not. - How Low Credit Score Credit Cards Work

These cards function similarly to traditional credit cards, allowing users to make purchases, pay bills, and manage their finances. Regular, on-time payments can help improve a user’s credit score over time. - Benefits of Low Credit Score Credit Cards

- Credit Building: Using these cards responsibly can help rebuild credit.

- Access to Credit: They provide a way to access credit when traditional options are unavailable.

- Financial Management: Credit cards can help with budgeting and tracking expenses.

Choosing the Right Low Credit Score Credit Card

- Assess Your Credit Score

Before applying, check your credit score to understand your financial situation better. Knowing your score helps you identify which cards you might qualify for. - Compare Fees and Interest Rates

Different credit cards come with varying fees and interest rates. Look for cards with low annual fees and manageable interest rates. - Check for Secured vs. Unsecured Options

Decide whether a secured or unsecured credit card suits your needs. Secured cards require a deposit but may be easier to obtain, while unsecured cards offer more flexibility. - Read the Terms and Conditions

Carefully review the terms and conditions before applying for a card. Look for hidden fees, grace periods, and penalty charges. - Consider Rewards and Benefits

Some low credit score credit cards offer rewards programs or benefits, such as cash back or discounts on certain purchases. These perks can make a card more attractive. - Look for Credit Reporting

Ensure the credit card issuer reports to the major credit bureaus. This is essential for rebuilding your credit score. - Customer Service and Support

Research the card issuer’s customer service reputation. A responsive customer service team can provide valuable assistance if you encounter issues. - Application Process

Review the application process for the card. Some issuers may have a quick online application, while others might require additional documentation. - Consider Initial Credit Limit

Look at the initial credit limit offered. A low limit is common for those with low credit scores, but it should be sufficient to meet your needs. - Avoid Prepayment Penalties

Some cards may charge fees for paying off your balance early. Look for cards that allow flexible payment options without penalties.

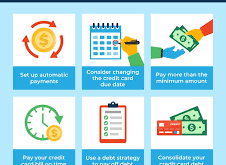

Managing Your Low Credit Score Credit Card Effectively

- Make Payments on Time

Timely payments are crucial for rebuilding your credit score. Set reminders or automate payments to avoid late fees. - Keep Credit Utilization Low

Aim to use less than 30% of your credit limit. High utilization can negatively impact your credit score. - Monitor Your Credit Report

Regularly check your credit report to track your progress and identify any errors that may need correction. - Consider Automatic Payments

Set up automatic payments for at least the minimum amount due to ensure you never miss a payment. - Avoid Unnecessary Purchases

Use your credit card wisely and avoid making unnecessary purchases that could lead to debt. - Request Credit Limit Increases

After demonstrating responsible usage, consider requesting a credit limit increase to improve your credit utilization ratio. - Diversify Your Credit

Over time, consider diversifying your credit portfolio with different types of credit, such as personal loans or auto loans. - Educate Yourself About Credit

Understanding credit fundamentals can empower you to make better financial decisions and improve your credit score. - Limit Hard Inquiries

Avoid applying for multiple credit cards simultaneously, as this can result in several hard inquiries on your credit report, which may lower your score. - Be Patient

Rebuilding credit takes time. Stay committed to responsible credit usage, and your score will improve gradually.

Tips for Using Low Credit Score Credit Cards Wisely

- Use Only When Necessary: Only use your credit card for essential purchases to manage debt effectively.

- Stay Within Your Budget: Create a budget that includes your credit card expenses to avoid overspending.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum amount due to reduce interest charges and pay off debt faster.

- Take Advantage of Grace Periods: Understand your card’s grace period and pay off your balance within that time to avoid interest charges.

- Educate Yourself About Interest Rates: Understand how interest rates work to avoid accumulating debt from unpaid balances.

- Use Alerts for Spending: Set up spending alerts to help you stay within your budget and avoid overspending.

- Review Statements Regularly: Regularly review your statements to ensure all transactions are accurate and identify any potential fraudulent activity.

- Keep Your Contact Information Updated: Ensure your credit card issuer has your current contact information for timely notifications regarding your account.

- Know Your Rights: Familiarize yourself with consumer protection laws related to credit cards to understand your rights and responsibilities.

- Seek Help if Needed: If you’re struggling with debt, don’t hesitate to seek financial counseling or advice from a professional.

Frequently Asked Questions (FAQs)

- What is a low credit score?

A low credit score is generally considered to be anything below 580 on a scale of 300 to 850. - Can I get a credit card with a low credit score?

Yes, there are credit cards specifically designed for individuals with low credit scores. - What is a secured credit card?

A secured credit card requires a cash deposit that serves as collateral, making it easier for those with low credit scores to obtain credit. - How can I improve my credit score using a low credit score credit card?

Making on-time payments, keeping credit utilization low, and regularly monitoring your credit report can help improve your score. - Are there fees associated with low credit score credit cards?

Yes, many low credit score credit cards come with annual fees, higher interest rates, and other charges. - How can I avoid credit card debt?

Create a budget, use your card only for necessary expenses, and pay off your balance in full whenever possible. - How often should I check my credit report?

You should check your credit report at least once a year, or more frequently if you’re actively working to improve your score. - Can I use a low credit score credit card for online purchases?

Yes, you can use most credit cards for online purchases, just like you would for in-store transactions. - What happens if I miss a payment?

Missing a payment can lead to late fees and negatively impact your credit score. - How long does it take to rebuild a credit score?

Rebuilding a credit score can take several months to a few years, depending on your financial habits and payment history.

Conclusion

Low credit score credit cards provide a valuable opportunity for individuals seeking to rebuild their credit and improve their financial situation. By understanding the features, benefits, and responsibilities associated with these cards, you can make informed decisions that align with your financial goals. Remember, responsible usage and timely payments are key to enhancing your credit score over time.

As you navigate the challenges of managing a low credit score, consider low credit score credit cards as a stepping stone towards financial freedom. With diligence and patience, you can regain control of your credit and set yourself on a path to a brighter financial future. Your credit score does not define your financial potential; rather, it’s your actions that will ultimately pave the way to success.

Related Posts:

- No Credit History Cards: Building Credit and…

- Low Income Credit Cards: Finding the Right Option for You

- Electric Vehicle Cashback Cards: Save on Your EV Expenses

- Instant Approval Credit Cards: Guide to Quick and…

- Best Credit Card for Millennials: Financial Freedom…

- First-Time Buyer Cards: Guide to Smart Credit Choices

credit.suarajatim.com

credit.suarajatim.com