Simple Credit Report: Accessing and Improving Financial Health. A simple credit report serves as a vital tool in understanding your financial standing. Whether you’re applying for a loan, renting an apartment, or just checking on your financial health, your loan report plays a crucial role. This article will explain what a simple loan report is, how to access it, and …

Read More »Credit Check

Debt Consolidation Score: Financial Stability for Better Credit

Debt Consolidation Score: Financial Stability for Better Credit. Debt consolidation is a popular financial strategy for managing multiple debts more efficiently. Understanding the concept of a debt consolidation score can empower you to make informed financial decisions. This comprehensive guide will cover everything you need to know about debt consolidation scores, including tips for improvement, common questions, and actionable advice. …

Read More »Soft Credit Request: Everything You Need to Know

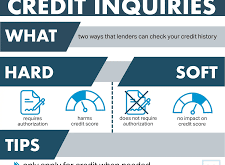

Soft Credit Request: Everything You Need to Know. A soft credit request is a crucial term in the world of personal finance and credit management. It plays a significant role in determining your financial opportunities without negatively impacting your credit score. This comprehensive guide will help you understand soft credit requests, their benefits, and their practical applications. What is a …

Read More »Free FICO Score: Improve Your Credit Score for Financial Success

Free FICO Score: Improve Your Credit Score for Financial Success. Your FICO score plays a crucial role in determining your financial health, influencing loan approvals, interest rates, and even job applications. In this comprehensive guide, we will explore how to check your free FICO score, its importance, and actionable tips to improve it. Introduction to Free FICO Score Understanding your …

Read More »Check Credit Approval: A Guide to Getting Approved

Check Credit Approval: A Guide to Getting Approved. Checking credit approval is an essential step when applying for loans, credit cards, or financing options. This process not only determines your eligibility but also impacts the terms and conditions you receive. Understanding how credit approval works can make the process smoother and increase your chances of success. In this article, we’ll …

Read More »Rental Credit History: Improving Rental Application Introduction

Rental Credit History: Improving Rental Application Introduction. When applying for a rental property, your rental credit history plays a crucial role in determining your eligibility. Many landlords use credit checks to evaluate your financial reliability and ability to pay rent on time. Understanding how your rental credit history affects your chances of approval and knowing ways to improve it can …

Read More »Auto Finance Credit: Guide to Managing Your Auto Loan

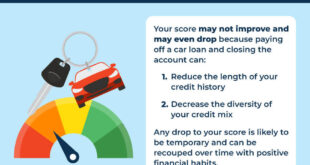

Auto Finance Credit: Guide to Managing Your Auto Loan. In the modern world, purchasing a vehicle is a significant financial decision. For most people, auto finance credit is the key to making this purchase possible. Auto finance credit allows buyers to obtain the funds needed to purchase a car, usually through a loan from a bank, credit union, or specialized …

Read More »Pre-check Credit Risk: What You Need to Know

Pre-check Credit Risk: What You Need to Know. Understanding and evaluating pre-check credit risk is an essential component of the financial world. Whether you’re an individual, business, or financial institution, managing credit risk is crucial for maintaining financial health. In this article, we will explore the significance of pre-check credit uncertainty, why it matters, how it works, and how to …

Read More »Car Loan Credit Check: Learning for a Smooth Financing Process

Car Loan Credit Check: Learning for a Smooth Financing Process. When you’re looking to finance a car, one of the crucial steps is the credit check. A car loan credit check plays a significant role in determining your loan approval and the interest rates you’ll receive. Understanding how it works can help you make informed decisions and improve your chances …

Read More »Update Credit Profile: Boost Your Credit Score and Financial Health

Update Credit Profile: Boost Your Credit Score and Financial Health. In the world of personal finance, your credit profile plays a vital role in shaping your financial future. A strong credit profile opens doors to lower interest rates, better loan terms, and access to higher credit limits. If you’re looking to improve your financial standing or simply maintain a healthy …

Read More » credit.suarajatim.com

credit.suarajatim.com