Apply for Credit: Guide to the Application Process, Tips, and FAQs. Applying for credit is a significant financial decision that can impact your credit score, financial future, and access to resources. Whether you’re applying for a credit card, loan, or mortgage, understanding the process and knowing what to expect is essential. This guide will walk you through how to apply …

Read More »Credit Check

Utility Bill Score: How Paying Bills Can Boost Credit Score

Utility Bill Score: How Paying Bills Can Boost Credit Score. In today’s financial world, a good credit score is essential for securing loans, getting credit cards, and even renting an apartment. Many people focus on traditional credit scoring factors like credit card payments and loan history, but there’s another way to boost your score that might not be on your …

Read More »Dispute Credit Inquiry: How to Handle Errors on Your Credit Report

Dispute Credit Inquiry: How to Handle Errors on Your Credit Report. In today’s financial world, your credit report plays a crucial role in determining your creditworthiness. However, errors on your credit report, particularly inaccuracies in credit inquiries, can negatively affect your score and financial decisions. A “dispute credit inquiry” is a formal request to correct any inaccuracies found in your …

Read More »Track Credit History: Understanding and Managing Your Credit

Track Credit History: Understanding and Managing Your Credit. Understanding and managing your credit history is vital for financial well-being. Whether you’re looking to apply for a loan, get a mortgage, or simply improve your financial health, keeping track of your credit history is crucial. This article explores how to track credit history, the benefits of monitoring it regularly, and tips …

Read More »24/7 Credit Update: Stay On Top of Your Credit Score Anytime

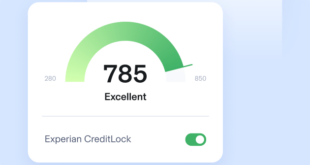

24/7 Credit Update: Stay On Top of Your Credit Score Anytime. In today’s fast-paced world, staying on top of your credit score is essential. With the rise of digital services, you can now monitor your credit score 24/7, providing you with constant insights into your financial health. A 24/7 credit update allows you to track changes in real-time, helping you …

Read More »Easy Credit Access: How to Secure Financing with Ease

Easy Credit Access: How to Secure Financing with Ease. In today’s fast-paced world, the need for easy credit access has become a crucial aspect of personal finance. Whether you’re looking to make a major purchase, consolidate debt, or handle an unexpected expense, having quick and simple access to credit can provide significant financial flexibility. However, securing credit can often be …

Read More »Monthly Score Monitor: Stay on Top of Your Credit Score

Monthly Score Monitor: Stay on Top of Your Credit Score. In today’s world, maintaining a healthy credit score is essential for financial success. A solid credit score can help secure loans, mortgages, and even job opportunities. However, many people overlook the importance of regularly monitoring their credit score. This is where a monthly score monitor becomes crucial. A monthly score …

Read More »Landlord Credit Report: Everything You Need to Know

Landlord Credit Report: Everything You Need to Know. When it comes to renting out properties, landlords often need a way to assess potential tenants’ financial responsibility. One of the best tools for this purpose is a landlord credit report. This vital document provides insights into a tenant’s creditworthiness, helping landlords make informed decisions before signing a lease. In this article, …

Read More »Building Credit Score: Guide to Improve Your Credit Rating

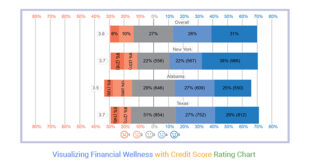

Building Credit Score: Guide to Improve Your Credit Rating. Building and maintaining a strong credit score is crucial for achieving financial goals. Whether you’re applying for a mortgage, car loan, or credit card, your credit score plays a vital role in determining the terms and interest rates offered to you. In this article, we will explore practical strategies, tips, and …

Read More »Trusted Credit Monitoring: Protecting Your Financial Health

Trusted Credit Monitoring: Protecting Your Financial Health. In today’s digital age, protecting your financial health has become more critical than ever. One of the best ways to safeguard yourself against identity theft, fraud, and credit score discrepancies is through trusted credit monitoring services. With a trusted credit monitoring system, you can stay informed about changes in your credit report, potential …

Read More » credit.suarajatim.com

credit.suarajatim.com