Check Credit Score: Learning for Better Financial Health. Your credit score plays a crucial role in your financial life. Whether you’re applying for a mortgage, auto loan, or credit card, lenders use your credit score to assess your creditworthiness. In this comprehensive guide, we will explain everything you need to know about checking your credit score, why it matters, how …

Read More »Credit Score

Improve Credit Score: Guide to Boost Your Financial Health

Improve Credit Score: Guide to Boost Your Financial Health. A good credit score is essential for financial stability. It affects your ability to secure loans, get better interest rates, and even qualify for rental properties. If you want to improve your credit score, this guide will provide detailed strategies to help you achieve that goal. Understanding Credit Score What is …

Read More »Improve Credit Health: Guide to Strengthening Financial Future

Improve Credit Health: Guide to Strengthening Financial Future. Improving your credit health is essential for financial stability and achieving your long-term goals. Whether you’re looking to buy a home, finance a car, or secure a loan for personal projects, a good credit score opens doors to better opportunities. This article provides you with a step-by-step guide on how to improve …

Read More »Good Credit Rating: Your Essential Guide to Financial Freedom

Good Credit Rating: Your Essential Guide to Financial Freedom. Maintaining a good credit rating is crucial for anyone seeking financial stability and opportunities. A good credit score opens doors to better loan rates, favorable insurance premiums, and even potential job offers. In this comprehensive article, we will explore the various aspects of good credit ratings, their importance, and how you …

Read More »Best Credit Score Tips: Guide to Improving Your Credit

Best Credit Score Tips: Guide to Improving Your Credit. Having a good credit score is essential in today’s financial landscape. It can affect everything from your ability to secure loans and credit cards to the interest rates you’ll pay. Improving your credit score may seem daunting, but with the right tips and strategies, you can take control of your financial …

Read More »Soft Credit Inquiry: Differences from Hard Credit Checks

Soft Credit Inquiry: Differences from Hard Credit Checks. Soft credit inquiries, also known as soft pulls, are an essential aspect of personal finance and credit management. Unlike hard credit inquiries, they don’t affect your credit score and often play a key role when applying for pre-qualification, checking your credit report, or getting background checks. For those looking to understand how …

Read More »Clean Credit Score: Essential Steps for a Financially Healthy Future

Clean Credit Score: Essential Steps for a Financially Healthy Future. A clean credit score is an asset that unlocks various financial opportunities, from securing loans to gaining lower interest rates on mortgages and credit cards. But many individuals face challenges maintaining a healthy score or improving a poor one. In this article, we’ll delve into actionable steps to clean up …

Read More »Credit Utilization Ratio: How It Works for Better Credit Scores

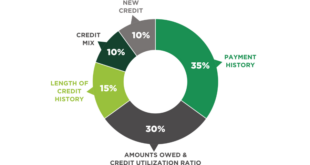

Credit Utilization Ratio: How It Works for Better Credit Scores. Maintaining a strong credit score is essential for financial well-being, and one of the key factors that significantly impacts your bank score is the Credit Utilization Ratio. Understanding how this ratio works, how it affects your bank, and the steps to improve it can empower you to make informed decisions …

Read More »Hard Credit Inquiries: Need to Know for Better Financial Health

Hard Credit Inquiries: Need to Know for Better Financial Health. Understanding bank inquiries, particularly hard bank inquiries, is essential for anyone looking to improve their credit score and manage their financial health. Hard bank inquiries are different from soft inquiries, and while they are routine when applying for new credit, they can impact your bank score if not managed carefully. …

Read More »How to Boost Credit: Strategies to Improve Your Credit Score

How to Boost Credit: Strategies to Improve Your Credit Score. Boosting your credit score is essential for accessing better financial opportunities, such as lower interest rates, higher credit limits, and easier approvals for loans and mortgages. Whether you’re starting from scratch or recovering from credit challenges, there are effective strategies you can use to enhance your credit. In this article, …

Read More » credit.suarajatim.com

credit.suarajatim.com