Credit Union Savings Accounts: Benefits and Choose the Right One. Credit unions offer an attractive alternative to traditional banks when it comes to saving money. As not-for-profit organizations, credit unions prioritize the financial well-being of their members, providing a range of financial services, including savings accounts. In this article, we will dive into everything you need to know about credit …

Read More »Credit Union

Credit Union Interest Rates: Guide to Maximizing Your Savings

Credit Union Interest Rates: Guide to Maximizing Your Savings. When it comes to saving money or borrowing funds, one of the most critical aspects to consider is the interest rate. For those who are part of or considering joining a credit union, understanding the interest rates they offer is essential. Credit union interest rates can significantly impact your financial decisions, …

Read More »Local Credit Union Loans: Application Process for Success

Local Credit Union Loans: Application Process for Success. In the world of personal finance, finding the best loan options is essential for securing your financial future. Many individuals turn to local credit unions for their lending needs. Local credit union loans offer several advantages over traditional bank loans, such as lower interest rates, personalized customer service, and a stronger community …

Read More »Best Credit Union Offers: Best Financial Deals for You in 2025

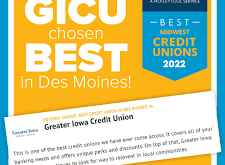

Best Credit Union Offers: Best Financial Deals for You in 2025. Credit unions are often an overlooked option when it comes to securing favorable financial deals. They typically offer better interest rates, lower fees, and more personalized services compared to traditional banks. This article explores the Best Credit Union Offers available today, providing a comprehensive guide to help you navigate …

Read More »Protect Your Credit Bureau Report: Strategies for Financial Health

Protect Your Credit Bureau Report: Essential Strategies for Financial Health. In today’s increasingly digital world, protecting your credit bureau report is crucial for maintaining your financial health. Your credit report significantly impacts your ability to secure loans, credit cards, and even housing. This article delves into the importance of safeguarding your credit report, explores effective strategies to protect it, and …

Read More »Check Bureau Records: Guide to Accessing Public Records

Check Bureau Records: Guide to Accessing Public Records. In today’s digital world, staying informed about the status of personal, financial, or business records is vital. Accessing accurate information is easier than ever with online bureau records. These records, held by various public bureaus and government agencies, contain data ranging from financial records to criminal histories. This guide provides insights on …

Read More »Credit Card with Points: Maximizing Rewards for Smart Spending

Credit Card with Points: Maximizing Rewards for Smart Spending. In today’s consumer-driven economy, credit cards have become essential tools for managing personal finances. One of the most appealing features of many credit cards is the rewards program, particularly those that offer points for every dollar spent. These points can be redeemed for a variety of benefits, from travel and merchandise to …

Read More »Best Credit Card for Travel: Maximize Your Rewards and Perks

Best Credit Card for Travel: Maximize Your Rewards and Perks. When it comes to traveling, having the right credit card in your wallet can make a world of difference. The best credit cards for travel offer significant rewards, travel perks, and flexibility that can save you money while enhancing your overall experience. Whether you’re a frequent flyer or an occasional traveler, …

Read More »Secured Credit Cards: Guide to Building Financial Independence

Secured Credit Cards: Guide to Building Financial Independence. Secured credit cards are often an essential tool for individuals looking to build or rebuild their credit history. Unlike unsecured cards, secured credit cards require a cash deposit as collateral, making them a lower-risk option for both the cardholder and the issuer. Whether you have a limited credit history or a poor credit …

Read More »Credit Union 401(k) Options: Exploring Retirement Savings Solutions

Credit Union 401(k) Options: Exploring Retirement Savings Solutions. Planning for retirement is crucial for ensuring long-term financial security. For many people, 401(k) plans are one of the most popular options for saving toward retirement, offering tax benefits and employer matching. However, credit unions can also provide unique 401(k) solutions that often come with a more personal, member-focused approach compared to traditional …

Read More » credit.suarajatim.com

credit.suarajatim.com